WAYS AND MEANS

Lincoln and His Cabinet and the Financing of the Civil War

By Roger Lowenstein

War, it has been said, is the midwife of revolution, an adage that certainly applies to the American Civil War. That conflict not only destroyed slavery, the foundation of Southern society, but also brought into being a newly empowered national state. Before the war the federal government had few responsibilities other than delivering the mail and dealing with Native Americans and foreign countries. States and localities were the loci of political authority. But the war vastly increased national power, economic as well as military. The federal government raised and spent unprecedented amounts of money and eagerly promoted economic development. The war laid the foundation for the American industrial leviathan of the late 19th century and created an enduring alliance between industrialists, financiers, the Republican Party and the government in Washington.

A vast literature exists on nearly every aspect of the Civil War. But Roger Lowenstein’s “Ways and Means,” an account of the Union’s financial policies, examines a subject long overshadowed by military narratives. Wars cost money as well as lives, and the Civil War required what Lowenstein calls “gargantuan” sums. In the hands of a less skilled author, the litany of bonds, notes, loans and forms of currency that he discusses could become mind-numbing. But Lowenstein is a lucid stylist, able to explain financial matters to readers who lack specialized knowledge. Perhaps he can write a book that helps laypersons like me understand recent innovations such as cryptocurrency and nonfungible tokens.

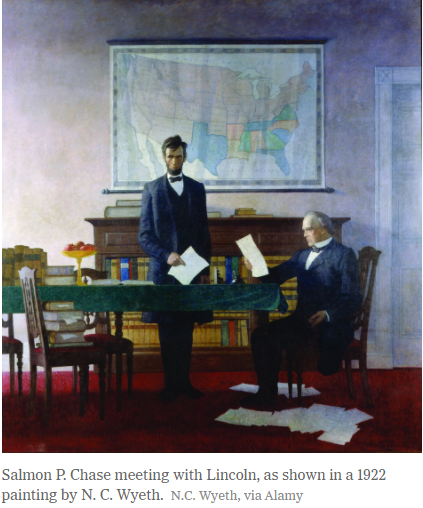

Preoccupied with the fate of slavery and events on the battlefield, Abraham Lincoln mostly left fiscal matters to Congress and his cabinet. Lowenstein’s key actors are hardly household names. They include William Pitt Fessenden, chair of the Senate Committee on Finance; Elbridge G. Spaulding of the House Ways and Means Committee; and especially Salmon P. Chase, secretary of the Treasury. Best known before the war for his commitment to freedom and equal rights for Black Americans, Chase is often denigrated by historians because of his massive ego (his theology, one contemporary remarked, was faulty: He thought there were four members of the Trinity). When the war began, the country had no common currency. Hundreds of local banks issued notes that circulated as money, while the federal government was required by law to deal only with gold and silver. With far too little specie available to meet wartime needs, the country almost immediately teetered on the edge of bankruptcy. But despite lacking prior experience in fiscal policy, Chase managed to finance the war and revolutionize the banking system.

Essentially, there are three ways to pay for a war: borrowing by selling bonds, levying taxes and printing money. Chase relied on all three. As the war progressed, the government issued hundreds of millions of dollars’ worth of bonds, and Chase spent much of his time badgering banks and wealthy investors to purchase them. He made a partial end run around the bankers with the help of the financier Jay Cooke, who employed an army of salesmen to market bonds directly to ordinary Americans, thus enriching himself via commission fees while helping to fill the nation’s coffers.

To raise further sums, Congress increased the tariff to unparalleled heights and imposed taxes — including the nation’s first income tax — on “everything under the sun,” in the words of one Treasury official. But what Lowenstein calls the most revolutionary departure came in 1862, when the federal government began printing “greenbacks,” paper money not redeemable in gold or silver but declared to be legal tender. Debtors, especially farmers, loved the greenbacks, since they could pay mortgages and other obligations in money worth considerably less than what they originally had borrowed. For the same reason creditors like bankers hated the new currency.

Ultimately, Lowenstein writes, Chase and the bankers were “fighting over the definition of money” and who should issue and control it, the government or private institutions. The National Banking Act of 1863, described by Lowenstein as “the most far-reaching financial reform in the country’s history,” authorized the government to charter a new system of banks, which would be required to purchase federal bonds, thus helping to finance the war. But, Lowenstein points out, the law’s official name was An Act to Provide a National Currency — something essential to a modern nation-state. A steep tax drove the money issued by local banks out of existence. By the war’s end, in place of the myriad forms of money previously in circulation there were only two — greenbacks printed by the federal government and the notes of the new national banks.

But the remaking of the financial system was only part of a new orientation of the nation’s economy. With the South no longer represented in Washington, the “scarcely remembered” 37th Congress, which convened in December 1861, enacted an economic agenda long blocked by slave owners. Much of it focused on the future of the West, the issue that had brought on the Civil War. Key initiatives were paid for with public land. The Homestead Act distributed free land to settlers; the Land Grant College Act provided territory to the states to finance new educational institutions; land grants helped to pay for the construction of a transcontinental railroad. Unfortunately, Lowenstein misses an opportunity to probe how all this acreage became “public land” in the first place. He praises the Union’s economic policies for promoting opportunity for “people on the rise.” But for Native Americans, they were a disaster. The free labor vision of a West that was home to railroads, mining companies and millions of family farmers presupposed evicting the region’s Indigenous peoples from their ancestral homelands.

Lowenstein devotes considerably less attention to Southern fiscal policy, but what he does say is scathing. The Confederate government relied far more heavily than the Union on the printing press. Over the course of the war, taxation supplied one-fifth of the federal government’s budget but only 6 percent of the Confederacy’s. The reason lay in the power structure of a slave society. The planters who controlled Southern politics and most of the region’s wealth knew that the burden of taxation would fall primarily on them, and they were not willing to share the pain. Paper money issued by Jefferson Davis’s administration, states and banks flooded the South. (Greenbacks bore Chase’s portrait; Southern currency often depicted slaves at work in cotton fields. The Confederacy was quite candid about what it was fighting for.) Rampant inflation followed, sapping morale, making ordinary economic exchanges difficult and inspiring bread riots in Southern cities. Lowenstein suggests that financial mismanagement may explain Confederate defeat. But as conflicts from the American Revolution to Afghanistan have demonstrated, the side with the greater firepower — military or financial — does not always win a war.

The economic policies of the wartime Union shaped the political conflicts of America’s Gilded Age. With the Republican Party in transition from defender of “free labor” to ally of the financial and industrial elite, the income tax lapsed, Wall Street solidified its hold on the nation’s financial assets, and the wartime tariff, a giant boon to manufacturers, remained in place. To no avail, dissenting groups sought to use the new centralized state for different purposes. The Greenback Party (perhaps the only political party in history named for a piece of currency) unsuccessfully called for increasing the supply of paper money to stimulate the economy during downturns. Populists demanded the nationalization of the railroads and credit system. Whose interests should the new political economy serve? In many ways that debate has never ended.

Eric Foner’s most recent book is “The Second Founding: How the Civil War and Reconstruction Remade the Constitution.”

WAYS AND MEANS

Lincoln and His Cabinet and the Financing of the Civil War

By Roger Lowenstein

Illustrated. 448 pp. Penguin Press. $30.